In this guide, we will show you how to setup a VAT Year in MAT Finance via the VAT Rates and Periods option.

Access: The minimum permission required to access VAT Rates and Periods is found in the Finance Module of Config>Setup>Roles & Permissions.

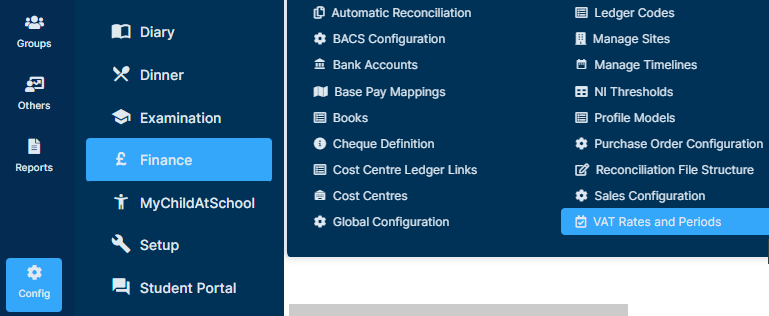

From the left Menu, go to Config>Finance>VAT Rates and Periods.

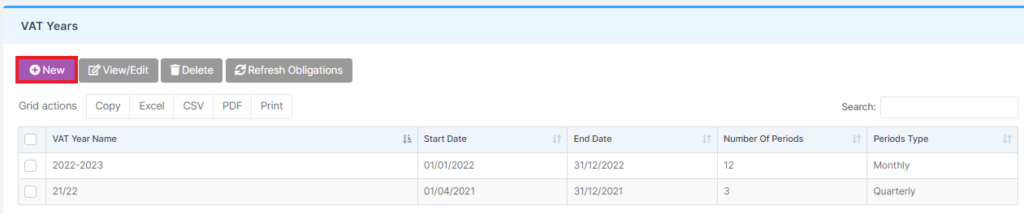

When the page loads you will see VAT Rates and VAT Years.

Within VAT Years press New.

Complete the VAT Year details and press Save. Any fields with * next to them are mandatory and must be completed.

This will then provide you with a breakdown of the VAT Periods and show whether you have submitted your VAT Return or 126 Report.

Press Close.

To open this at any time go to Config>Finance>VAT Rates and Periods and then select the relevant year in VAT Years and either double click or select Edit.

VAT Rates should be added as part of the setup.